geothermal tax credit iowa

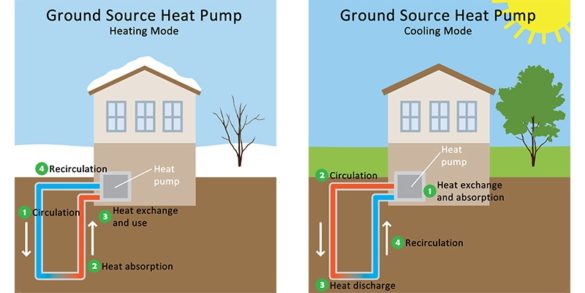

Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa.

How The 2022 Federal Geothermal Tax Credit Works

Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential.

. The Geothermal Tax Credit did not require a federal credit and therefore was available during years when there was no federal geothermal credit. Taxpayers filing a claim for the Geothermal Tax Credit must submit Form IA 140 in addition to Schedule IA 148 with the individual income tax return. Check Out the Latest Info.

When multiple housing cooperatives or horizontal property regimes incur expenses that qualify for the tax credit taxpayers owning and. Since geothermal systems are the most efficient heating and cooling units available the united. See Iowa Code section 42211N.

The credit became available on January 1 2009 and sunsets January 1 2021. Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed. Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit.

The Iowa Geothermal Tax Credit is. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. The Geothermal Heat Pump Tax Credit is available for qualified installations on residential property located in Iowa.

2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as. Ad Iowa Geothermal Tax Credit. The State credit equals 200 of the federal Residential Energy.

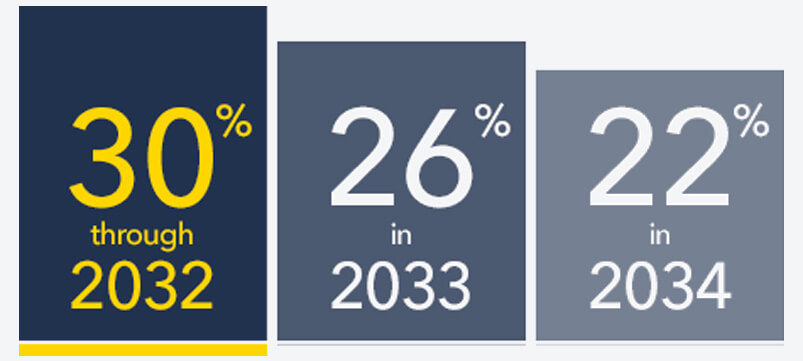

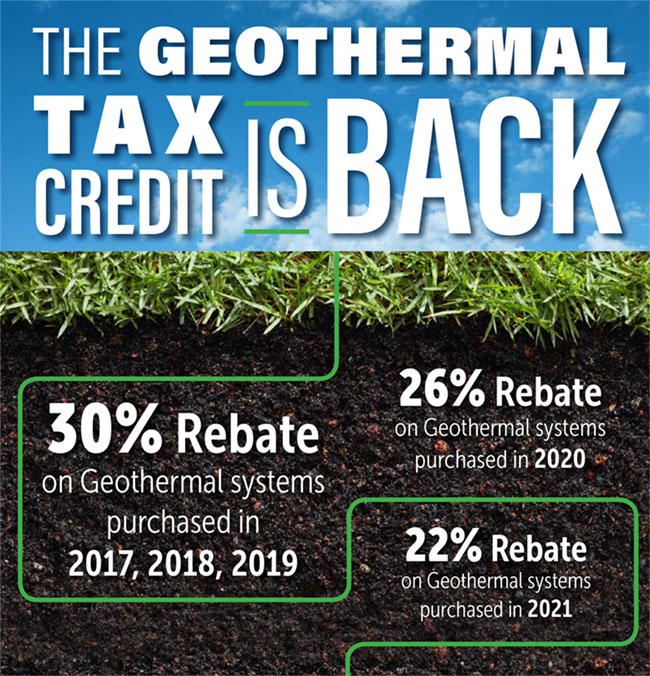

The tax credit equals 10 of. Browse Our Collection and Pick the Best Offers. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through.

Eligible for a new Iowa Geothermal Tax Credit in 2018. Taxpayers filing a claim for the Geothermal Tax Credit were required to submit Form IA 140 in addition to the IA 148 with the individual income tax return. The State credit equals 200 of the federal Residential Energy.

It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what. Effectively a 6 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 30 for. The highest tax credit available is 008 per pure ethanol gallon.

This rule making implements the Iowa geothermal heat pump income tax credit enacted in 2019 Iowa Acts House File 779 for geothermal heat pumps installed on residential property. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit. Available to the residentowner of an iowa residence who installs.

The federal credit was later reinstated and. Iowa geothermal tax credit. Effective for installations between January 1 2012 and December 31 2016 and for installations after January 1 2019 a Geothermal Heat Pump Tax Credit is available for individual income.

The Geothermal Tax Credit is classified as a non-refundable personal tax credit.

Dandelion Energy Celebrates New Tax Credit For New York Homeowners Who Install Geothermal Systems Dandelion Energy

Iowa S Geothermal Tax Credit Is Back

Colorado Geothermal Drilling Blog Colorado Geothermal Drilling

Iowa S New Tax Structure In 2022 And Beyond

Geothermal Heating Win In Iowa Simco Drilling Equipment Water Well Drilling Rigs And Equipment Geothermal Drilling Rigs Equipment Parts And Service

Geothermal State Federal Tax Credits Dandelion Energy

Geothermal Heating And Cooling Sioux City Iowa Excel Comfort Inc

Colorado Geothermal Drilling Blog Colorado Geothermal Drilling

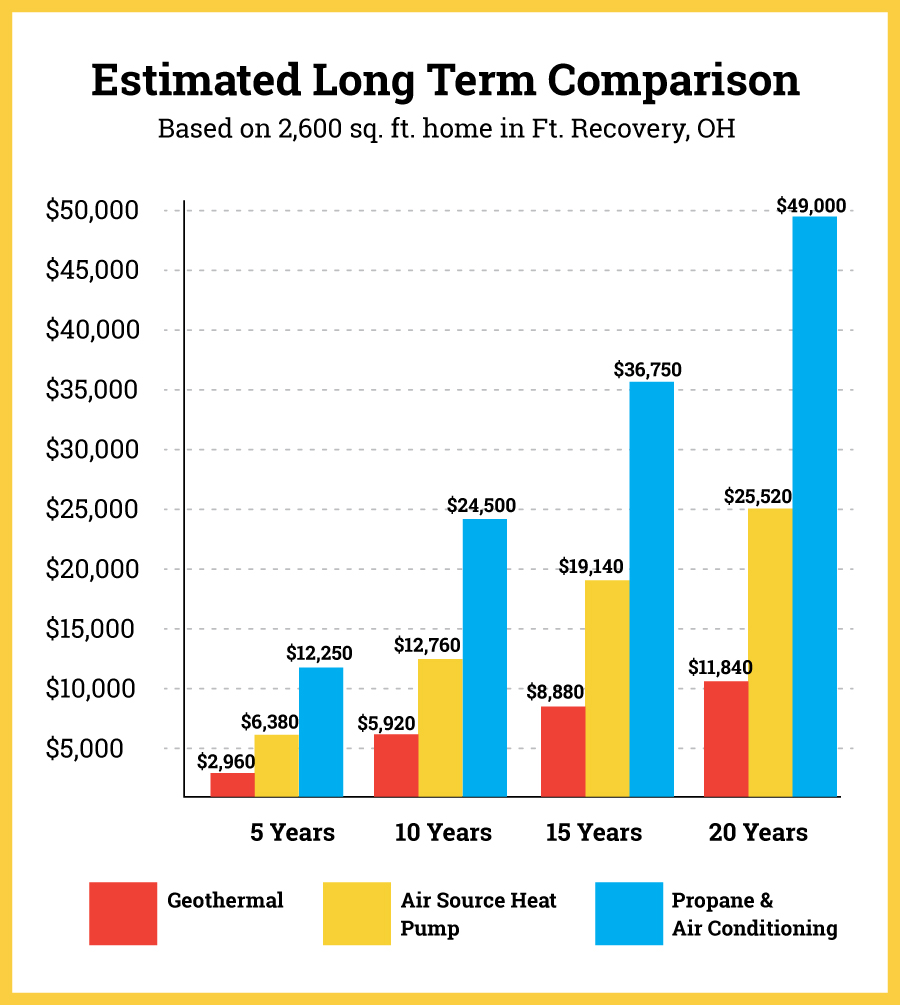

Cost Savings Comparison Buschurs Refrigeration

Geothermal Tax Credit Reinstated Corken Steel Products

Geothermal Installation R J Nelson Heating Air Council Bluffs Iowa Omaha Nebraska

Eastern Iowa Geothermal Inc Posts Facebook

Federal Geothermal Tax Credits Are Back

As Interest In Solar Grows In Iowa So Does The Waitlist For State Tax Credit Energy News Network

Form Ia 148 Fillable Tax Credits Schedule 41 148

Geothermal North Central Iowa Service

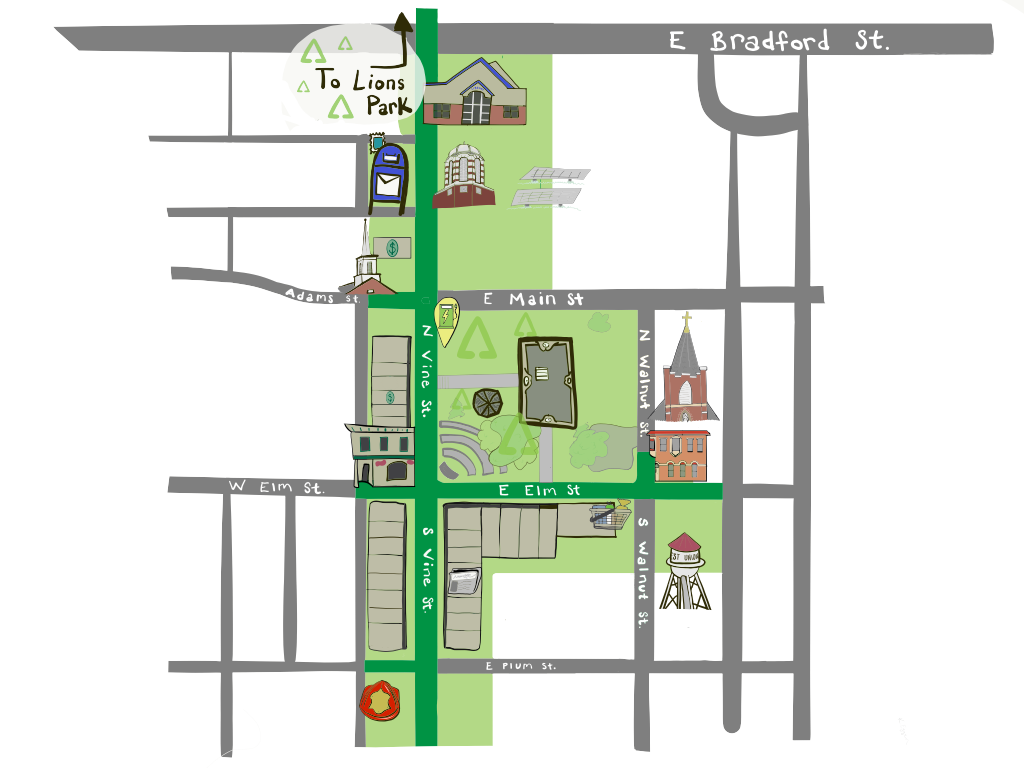

Standards And Best Practices Green Up West Union

Patty Fulton Jennifer Breeden Ppt Download

New Tax Credit Make Solar A Better Investment For Iowans Iowa Environmental Focus